What’s Your Effective Tax Rate?

This year’s tax season is now over, but I suspect the discussion on taxable income and effective tax rates is just beginning. With the upcoming presidential election, there’s been a lot of media attention placed on the percentage of income that each candidate pays in taxes. While I believe each candidate’s position on the issues should be the focus of this year’s campaign season, ‘spirited’ arguments on income and taxes will likely be a hot topic. Although we all pay taxes, unless you’re a financial professional, you may or may not know how to calculate your effective tax rate. The purpose of this Post is to provide instructions on how to calculate it.

I know you’ve heard the news that Warren Buffet’s secretary has a higher tax rate than he does, and I’m sure you’re wondering how this is even possible. The short answer is not all sources of income are created equally. Most middle class Americans work in order to earn a living, but wealthy people focus on creating income without having to ‘work’ to get it. The term used by the IRS to describe this form of income is passive. According to livingoffdividends.com, examples of passive income include rental properties, partnership returns, and qualified dividends. In an ABC News Special, Warren Buffet communicated that he hardly pays any payroll taxes, but his secretary and the average working American’s primary tax is likely payroll taxes. During the interview, Buffet disclosed that his tax rate was 17.4 while his secretary’s rate was 35.8.

If you’d like to compare your rate to Warren Buffet’s, you can use the following formula:

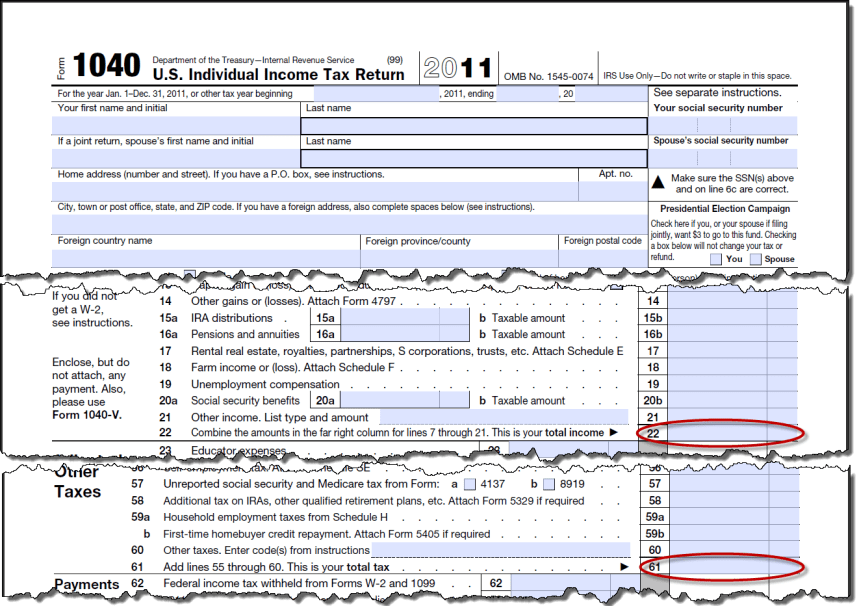

Effective Tax Rate = Total Taxes (Line 61) / Total Income (Line 22)

If you filed a 1040 tax form, the diagram included below can assist you in pulling the appropriate line items for the calculation: